History

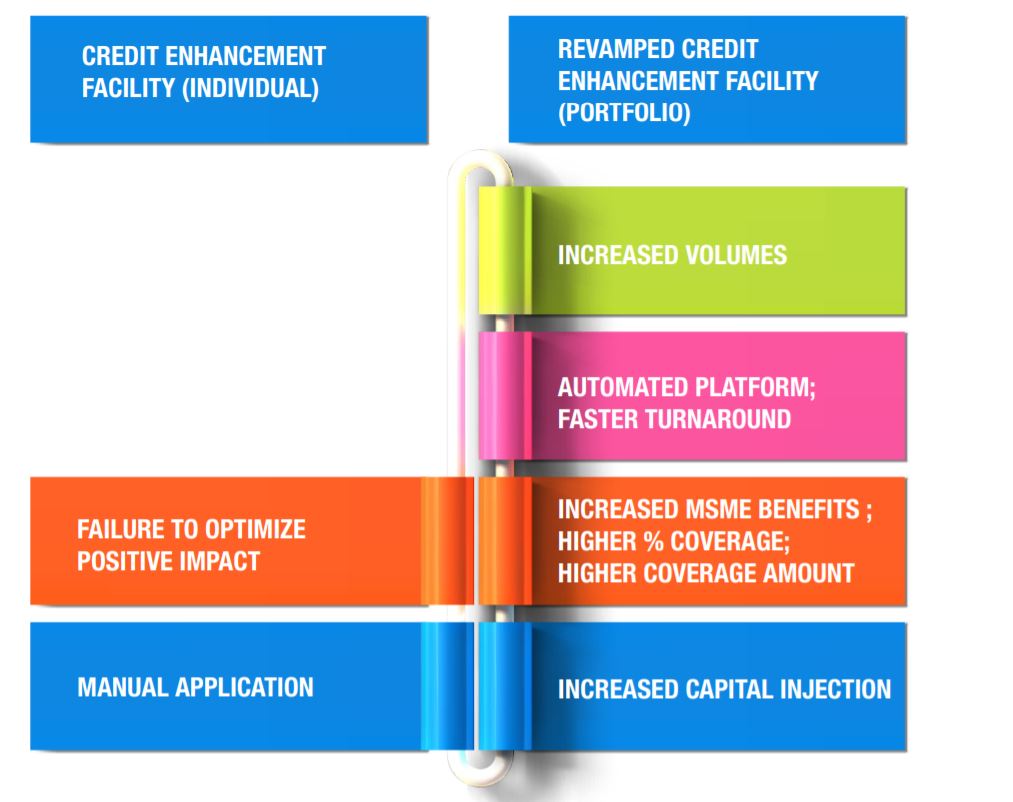

In 2009, the DBJ pioneered the Credit Enhancement Facility (CEF), a partial loan guarantee that helps Micro, Small and Medium-sized Enterprises (MSME) without adequate collateral to access loans from financial institutions.

The CEF is a risk-sharing arrangement under which the DBJ provides partial guarantees to financial institutions and, in effect, increase lending to MSMEs.

The primary objective of the CEF is to reduce the risk exposure normally associated with small business lending, thereby allowing eligible MSMEs with viable projects to access term loans.

International Recognition

In 2015, the Credit Enhancement Facility received an award from the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) for its role in addressing the challenges of MSMEs’ access to finance. The facility has also attracted the support of the Inter-American Development Bank (IDB) and World Bank which provided Technical Assistance to improve the structure and operation of the CEF.

The CEF is part of a holistic business ecosystem that the DBJ is building to support economic growth and development in Jamaica. Other elements in that system include:

- Vouchers for Technical Assistance (up to J$200,000)

- Energy Audit Grants (up to J$200,000)

- Venture Capital Programme

- Public-Private Partnerships and Privatization and;

- Loans to MSMEs for start-ups and expansion

DBJ Business Ecosystems

The CEF is part of a holistic business ecosystem that the DBJ is building to support economic growth and development in Jamaica. Other elements in that system include:

- Vouchers for Technical Assistance (up to J$200,000)

- Energy Audit Grants (up to J$200,000)

- Venture Capital Programme

- Public-Private Partnerships and Privatisation; and

- Loans to MSMEs for start-ups and expansion